General Concerns around Guarantors transferring assets

What if the Guarantor is a self settled trust for example?

GoDocs' existing documents provide functional coverage for this risk, while affording greater flexibility across jurisdictions.

How the Existing GoDocs Documents Address This Issue

Rather than addressing self-settled trusts through state-specific representations and covenants, the GoDocs documents approach this issue more broadly and, in practice, more effectively:

-

Material Adverse Effect Standard (Loan Agreement)

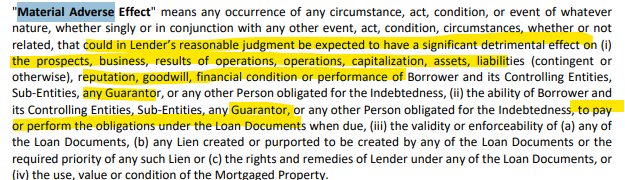

Your Loan Agreement defines “Material Adverse Effect” expansively to include any event or condition that could reasonably be expected to have a significant detrimental effect on:-

a guarantor’s assets or financial condition, or

-

a guarantor’s ability to perform its obligations under the loan documents.

-

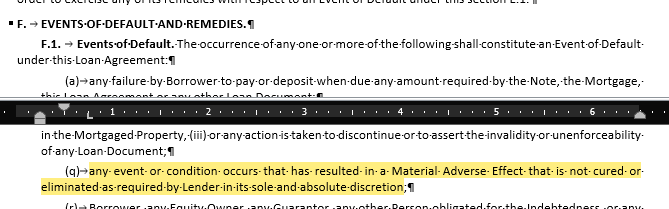

Any transfer of assets into a self-settled trust or similar structure that impairs a guarantor’s financial condition or ability to perform would fall squarely within this definition and may constitute an Event of Default under Section F.1(q).

-

Restrictions on Asset Transfers (Guaranty)

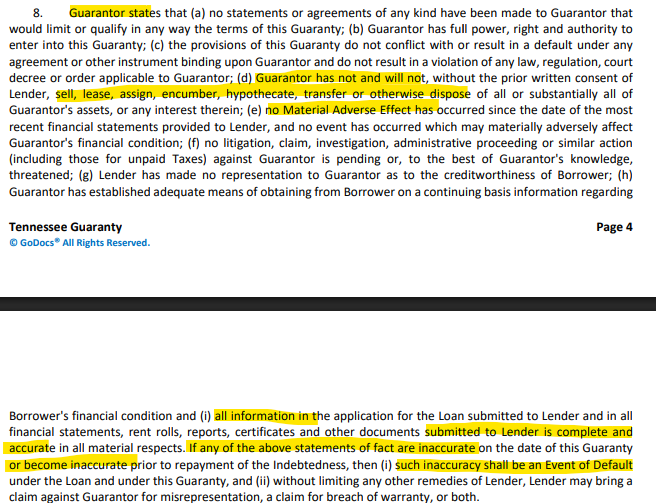

The Guaranty expressly provides that the Guarantor may not, without Lender’s prior written consent, “sell, lease, assign, encumber, hypothecate, transfer or otherwise dispose of all or substantially all of Guarantor’s assets.”Transfers of assets to a trust—whether self-settled or otherwise—that materially diminish the guarantor’s asset base are captured by this restriction. -

Representations as to Financial Condition and Disclosure (Guaranty)

The Guaranty requires that all financial statements and related disclosures provided to the Lender are complete and accurate in all material respects, and that no Material Adverse Effect has occurred.Failure to disclose assets held in trust, or transfers designed to avoid creditor claims, would constitute a misrepresentation and an Event of Default, triggering lender remedies. -

Event of Default and Remedies

Any inaccuracy in representations, undisclosed asset transfers, or actions materially impairing the guarantor’s financial condition automatically triggers an Event of Default and preserves the lender’s full remedies, including claims for misrepresentation or breach of warranty.

Why Additional State-Specific Language Is Not Required

As an example, Tennessee-specific language, is narrowly tailored to a particular statutory regime. By contrast, the current GoDocs guaranty provisions:

-

apply uniformly across all jurisdictions,

-

capture a broader range of asset-transfer scenarios (not limited to named trust types), and

-

avoid the need to track evolving state trust statutes or naming conventions.

As such no state-specific language is required as it would reduce flexibility or introduce state-by-state maintenance considerations.