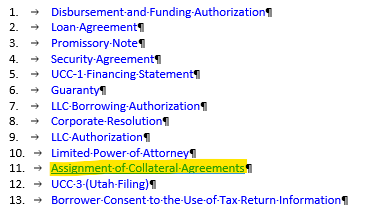

Selecting "Collateral Assignment" for C&I loan documents

Under the Collateral Tab is the selection for "Has Collateral Assignment:"

-png-3.png?width=475&height=180&name=image%20(6)-png-3.png)

What that “Collateral Assignment” means

When you select Yes to Collateral Assignment in GoDocs, the system generates a short set of assignment documents that sit behind the Note. These documents do not change who owns the collateral today.

In Section H.10 or thereabouts of the Loan Agreement:

-png-2.png?width=583&height=691&name=image%20(4)-png-2.png)

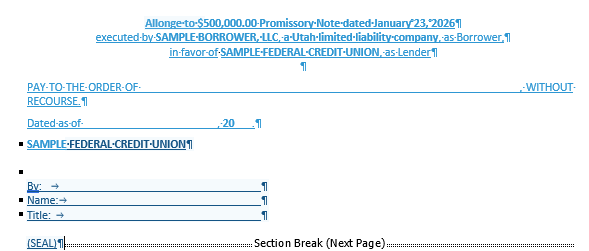

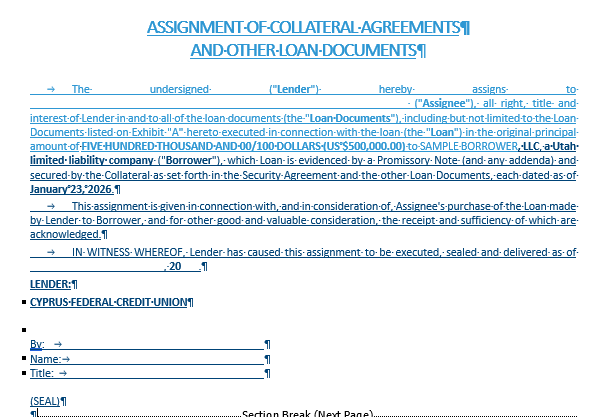

An Allonge and Assignment of Collateral Agreements after the Promissory Note:

Instead, they do one thing:They give the lender the ability to assign or transfer its interest in the loan and related collateral to another party in the future, if the lender ever sells, participates, or pledges the loan. That is why an extra page/documents (e.g Allonge, Assignment of Collateral Docs, etc.) appear after the Note.

Why the assumption makes sense (and where the distinction is)

The collateral is already assigned to lender in the normal sense:

- The Mortgage / Deed of Trust secures the real estate and/or the Security agreement secures the business assets

- The Loan Agreement and Note tie the debt to that collateral

Those documents already give you full security interest as the lender. The Collateral Assignment is different. It is not about assigning collateral to you. It is about allowing you, as lender, to later assign your lender position out to someone else if needed. Why this is usually not applicable for a Credit Union.

For a Credit Union that:

- Holds loans in portfolio

- Is not selling loans to investors

- Is not doing participations or warehouse financing

These assignment documents are typically unnecessary. They mostly exist for lenders that routinely:

- Sell loans

- Securitize loans

- Participate loans

- Pledge loans to third-party financing sources

That said, including them does not hurt anything.

Why there’s no downside to including it

If included:

- Only the lender executes these documents

- The borrower’s obligations do not change

- No additional recording or borrower burden is created

- It simply adds optional flexibility for the lender

If excluded:

- The loan is still fully secured and enforceable

- You just won’t see those extra assignment pages

As such if you want the cleanest, shortest package for portfolio loans: select No. If you want optional future flexibility and don’t mind extra pages: select Yes.