Where do I go to include a Ground Lease?

Specific Ground Lease information can be added to your order from the "Property Tab".

Description

A typical ground lease is a land lease agreement wherein the lessee or tenant pays rent on a parcel of land and can build and modify the property there. After the lease term is up, the leased land, all new property built on it, and any additions to that current property transfer in ownership to the landlord or lessor.

User Interface

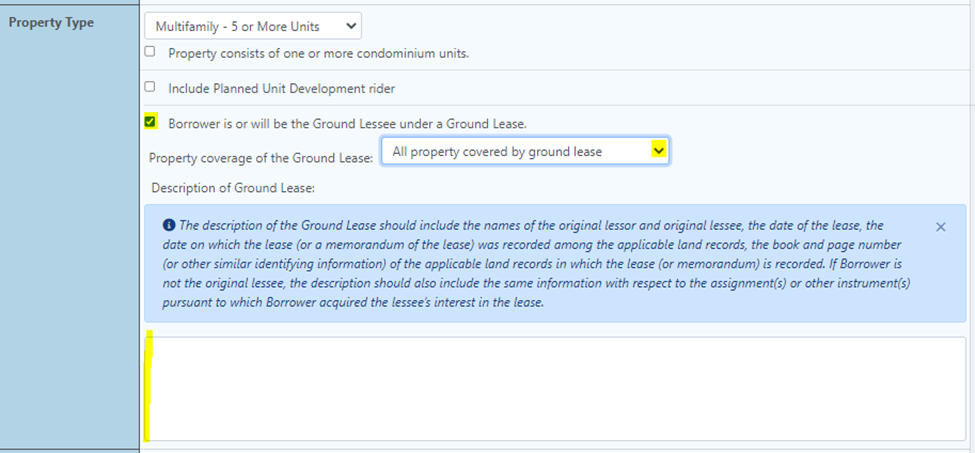

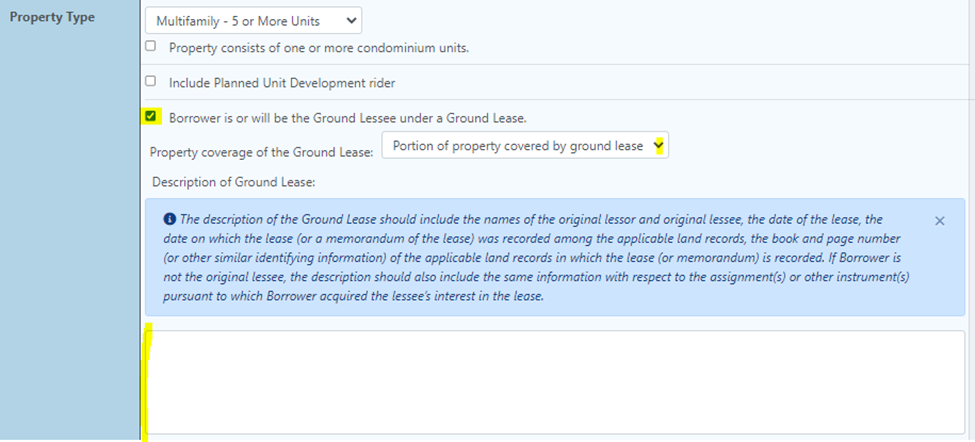

Navigate to the "Property Tab" and scroll down to the "Property Type" section.

Select the check box that says "Borrower is or will be the Ground Lessee under a Ground Lease"

Then select the appropriate option for ground lease coverage, and use the instructions below in blue to complete the description of the ground lease

(a) All property covered by ground lease

(b) Portion of property covered by ground lease

GoDocs Software Output Sample

The description of the Ground Lease input in the Order will appear on the following Exhibit