How do I add a Spousal Consent Waiver and when is it used?

GoDocs has identified, through our 50-state compliance process, that certain states have laws and legal structures that impact married participants in loans based on the property state, signatory residence states and governing law state, as applicable. As such the system will offer the ability to either indicate if a signer is married or not so that the user can check the box, when applicable. The system will offer a reminder of the spouse's participation, or non-participation, based on the data entry of the order.

An identified state: "Based on your data entry, a separate spousal waiver and consent document will be included and the spouse should sign the security instrument or guaranty, as applicable, as a non-party to the loan or guaranty concerning his/her interest in collateral or assets at issue".

Not an identified state: "Based on your data entry, this state does not require a separate spousal waiver and consent document, nor must the spouse sign the security instrument or guaranty, as applicable, as a non-party to the loan or guaranty concerning his/her interest in collateral or assets at issue".

Not an identified state: "Based on your data entry, this state does not require a separate spousal waiver and consent document, nor must the spouse sign the security instrument or guaranty, as applicable, as a non-party to the loan or guaranty concerning his/her interest in collateral or assets at issue".

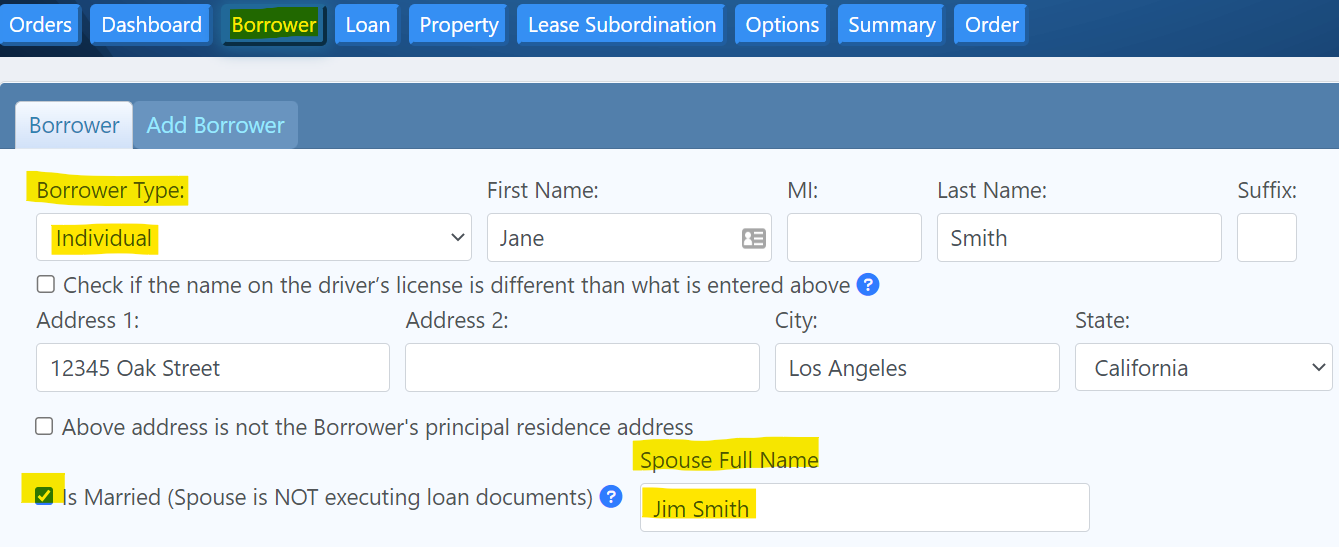

When a Borrower is an Individual they will have the option on the "Borrower" tab to check a box that reads "Is Married (Spouse is NOT executing loan documents)," and a "Spouse Full Name" data field will populate.

To view a sample of the generated Spousal Waiver and Consent portion of the documents please click on the link below.

If a Guarantor is domiciled in a community property state, property acquired during the marriage is community property and cannot be separated. Consequently, these states typically require both spouses to sign the Guaranty. There are nine(9) community property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

Including "non-signing" spousal signature blocks at the end of certain DOTs/Mortgages"

In a commercial real estate (“CRE”) transaction, the borrower is typically the mortgagor. In those instances, when the lender makes the loan to the borrower/mortgagor, the borrower/mortgagor agrees to pledge the subject property to the lien of the lender’s security instrument to ensure performance of certain obligations, most notably the repayment of the lender’s loan. When the borrower/mortgagor pledges the property, and, importantly, when the borrower/mortgagor is an individual (not an entity such as a corporation or LLC), the borrower/mortgagor is also agreeing to waive any statutorily protected right or interest he or she may in and to the property afforded by the laws of the property state.

GoDocs includes a standalone, off-record Spousal Waiver and Consent document in its loan document packages when the data entry for a CRE order reflects (i) the borrower/mortgagor is an individual; (ii) is married; and (iii) any of the property states noted above are involved in the transaction. Separately, and in order to ensure compliance with state law as it relates to community property laws, homestead exemptions, and dower/curtesy, and otherwise out of an abundance of caution in connection therewith, that same data entry triggers inclusion of a “non-signing” spousal signature block at the end of the security instrument, which clearly and conspicuously notes the spouse is only executing the security instrument in order to subject to the lender’s lien, or otherwise waive, any right/interest the spouse may have in and to the property by virtue of community property, homestead exemption, or dower/curtesy laws. The spouse’s execution of the security instrument as a “non-signing” person does not make him or her subject to the loan nor obligate him or her to any performance in connection with the loan. There is also a practical reason why the “non-signing” signature blocks are included in applicable security instruments: many of our customers sell their mortgage loans to third parties. For this reason, we are cognizant of the fact that not all off-record documents (e.g., the Spousal Waiver and Consent) may “travel” with the assigned loan documents (or may be inadvertently left behind or lost). To that end, we want to protect our customers, and by extension their mortgage loan buyers, from any potential argument by the borrower/mortgagor and/or spouse that the spouse did not subject or waive such rights/interests at the time of the closing. GoDocs is committed to ensuring our loan documents are compliant and address practical considerations important to our customers, neither of which are mutually exclusive.

In such instances, it is imperative that the lender also ensure the spouse subject or otherwise waive any such rights or interests he or she may also have in and to the property by virtue of being married. The three main rights/interests lenders need to be cognizant of are: (i) community property rights; (ii) a homestead exemption; and (iii) a dower/curtesy interest. While those rights/interests may not be relevant to every CRE transaction, it is wise for the lender to ensure that in the event any of the foregoing three are applicable that the lender receive a spousal waiver and consent to the lender’s intended lien being prior and superior to the spouse’s rights/interests in and to the property. A good rule of thumb is: if the borrower/mortgagor must waive those rights/interests, so too should the spouse.

Community Property

With respect to CRE transactions where the property is in a community property state, nearly every such state requires, by statute, the spouse join in the execution of the security instrument. The intent of those laws is to ensure that property purchased by the “community" (acquired during marriage) is not encumbered without all persons who have a right in and to that property consenting to a lender’s lien (see, e.g., Cal. Fam. Code. § 1102; Ariz. Rev. Stat. Ann. § 25-214(C); Idaho Code § 32-912; LSA-C.C. Art. 5347; NRS 123.230; N.M. Stat. Ann. § 40-3-13; Wash. Rev. Code § 26.16.030(3).)

Homestead Exemption

While not relevant to the majority of CRE transactions, most states protect a spouse’s right to the equity in the borrower/mortgagor and spouse’s home up to a certain dollar amount. As such, a homestead exemption would be inapplicable when the collateral real property is a true commercial property, e.g., a strip mall, gas station, or a multi-family property, e.g., an apartment or condominium complex. However, it may be applicable to a residential 1-4 unit (or 1-6 unit, depending on the state) property which secures a commercial/business purpose loan. While lenders are already vigilant in ensuring the borrower/mortgagor represents that such loans are for business purposes and are not occupied by the borrower/mortgagor, unfortunately, misrepresentations can, and do, occur. To that end, it is wise for the lender (or is required by law, as applicable) to have the spouse execute the security instrument to waive his or her homestead exemption in and to the property.

Dower/Curtesy

Even though they have been abolished in nearly every state, dower and/or curtesy rights remain in a few (e.g., Ohio, Kentucky). Generally speaking, dower and curtesy provide the surviving spouse with a right to the deceased spouse’s property, including real property. With this in mind, a surviving spouse’s dower or curtesy interest could negatively affect the lender’s lien, and by extension, impact the disposition of a lender-foreclosed property, by taking precedence over the lender’s interest in and to the entirety of the property. For this reason, it would be beneficial for the lender (or is required by law, as applicable) to have the spouse execute the security instrument to waive his or her dower or curtesy interest in and to the property.

State by State Breakdown for Individual Borrowers

|

State |

Separate Spousal Waiver (Borrower Location) |

Spouse required to sign DOT/Mortgage (Property Location) |

|

Alabama |

Yes |

Yes |

|

Alaska |

Yes |

Yes |

|

Arizona |

Yes |

Yes |

|

Arkansas |

Yes |

Yes |

|

California |

Yes |

Yes |

|

Colorado |

Yes |

Yes |

|

Connecticut |

No |

No |

|

Delaware |

No |

No |

|

District of Columbia |

No |

No |

|

Florida |

Yes |

Yes |

|

Georgia |

No |

No |

|

Hawaii |

No |

No |

|

Idaho |

Yes |

Yes |

|

Illinois |

Yes |

Yes |

|

Indiana |

No |

No |

|

Iowa |

Yes |

Yes |

|

Kansas |

Yes |

Yes |

|

Kentucky |

Yes |

Yes |

|

Louisiana |

Yes |

Yes |

|

Maine |

No |

No |

|

Maryland |

No |

No |

|

Massachusetts |

Yes |

Optional - reach out Customer Support |

|

Michigan |

Yes |

Yes |

|

Minnesota |

Yes |

Yes |

|

Mississippi |

Yes |

Yes |

|

Missouri |

Yes |

Yes |

|

Montana |

Yes |

Yes |

|

Nebraska |

Yes |

Yes |

|

Nevada |

Yes |

Yes |

|

New Hampshire |

Yes |

Yes |

|

New Jersey |

Yes |

Yes |

|

New Mexico |

Yes |

Yes |

|

NewYork |

No |

No |

|

North Carolina |

Yes |

Yes |

|

North Dakota |

Yes |

Yes |

|

Ohio |

Yes |

Yes |

|

Oklahoma |

Yes |

Yes |

|

Oregon |

No |

No |

|

Pennsylvania |

Yes |

Yes |

|

Rhode Island |

No |

No |

|

South Carolina |

No |

No |

|

South Dakota |

Yes |

Yes |

|

Tennessee |

Yes |

Yes |

|

Texas |

Yes |

Yes |

|

Utah |

No |

No |

|

Vermont |

Yes |

Yes |

|

Virginia |

No |

No |

|

Washington |

Yes |

Yes |

|

West Virginia |

Yes |

Optional - reach out Customer Support |

|

Wisconsin |

Yes |

Yes |

The spousal notary page for the Certificate of Non-Owner Occupancy is included because it is an Indiana state requirement. It is required when the borrower is an individual and the property is in the state of Indiana.