How to Add/Remove a Borrower, Borrower’s Address and married status?

Under the Borrower tab, the user will see "Add Borrower".

To remove a Borrower clear the data entry data fields and click the trashcan icon on the far right.

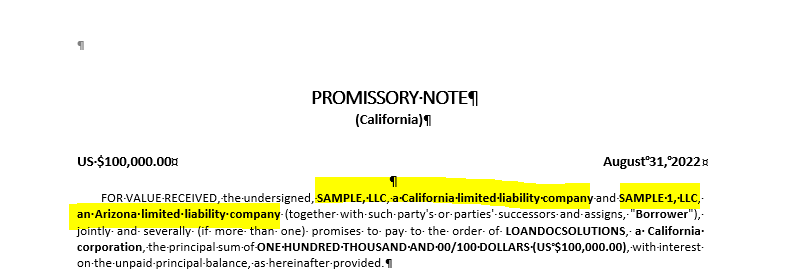

GoDocs Software Output Sample

1 Borrower:

2 Borrowers:

More than 1 Borrower and each with different principal residence:

If Borrower 2 has a different residential address than the one listed for Borrower 1 please check the "Borrower 1 address is not the Borrower's principal residence address" box. That will trigger an option to input the Borrower's principal residence address, which may be applicable in documents based on state, other data entry, etc. The "Borrower 1 address is not the Borrower's principal residence address" box will only appear if Borrower 2 is an Individual Borrower.

If the Borrower is married, do I check the "is married" box?

The checkbox is designed for a spouse not executing loan documents as it is used to indicate the preference of the customer to include a spousal waiver in the documents.

If a Borrower is domiciled in a community property state, then the Borrower's spouse must consent to any transfer or lien against any community property asset pledged as security for the loan. Similarly, if a Guarantor is domiciled in a community property state, unless the spouse consents to the Guarantor's execution of the subject Guaranty, the lender will only have recourse against the Guarantor's 50% interest in the community property and the Guarantor's separate property. Accordingly, lenders making loans in community property states require both spouses to sign the Mortgage (with respect to imposing a lien against the Borrower's interest in community property assets) and the Guaranty (with respect to being able to seek recovery against the full community property estate when enforcing the guaranteed obligations of the Guarantor). The following 9 community property states include: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

GoDocs Software Output Sample