Lender protections when Borrower fails to pay property taxes

Lender protections should Borrower not pay property taxes.

Section D.1 (a) of the Loan Agreement requires all Taxes to be paid.

Section F.1(a) of the Loan Agreement identifies that any failure by the Borrower to pay or deposit any amount required to constitute an Event of Default.

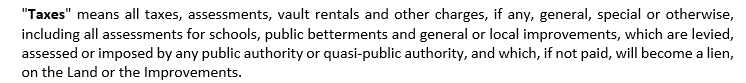

Taxes are defined in the Loan Agreement and Deed of Trust.

The power of sale when an Event of Default has occurred is a remedy available to the Lender.

If property taxes are not paid, the Lender could also have the option to pay those taxes to maintain the Lender's lien security (section G.1 of the Deed of Trust).

Such funds would become a part of the Indebtedness, shall be immediately payable and shall bear interest at the Default Rate (section G.2 of the Deed of Trust).

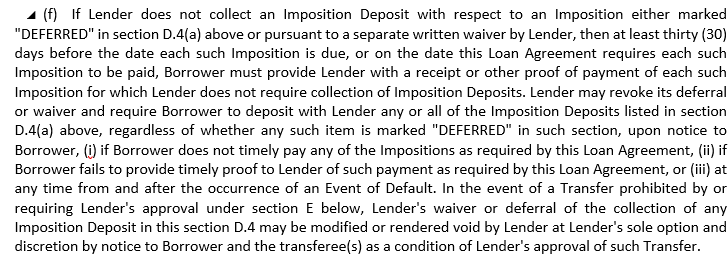

The Lender could then, also, require the Borrower impound for future taxes (section D.4(f) or thereabouts of the Loan Agreement).