What is a Repair Agreement / Repair Holdback and how would I order one?

This will detail when you will need a Repair Agreement / Repair Holdback.

Repair reserves are used when specific items are identified as needing repair at the time of closing - typically for minor items. This differs from a replacement reserve which covers items likely requiring either routine, ongoing maintenance and/or replacement after closing and during the term of the loan. For example, a repair reserve could require Borrower to repair a cracked sign in the parking lot within 60 days of closing.

GoDocs offers several types of repair agreements: Deposit of Loan Funds, Holdback of Loan Funds, Holdback of Loan Funds (Full Loan Interest Accrued), Holdback of Loan Funds Option 2, and Holdback of Loan Funds (Full Loan Interest Accrued) Option 2.

To enter this example into the system please follow the below steps.

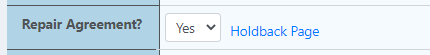

Step 1: Navigate to the "Property" tab and select "yes" to Repair Agreement

Step 2: Navigate to the Holdback Page (click on the link next to "yes")

Step 3:Enter all necessary information (see examples below)

Deposit of Loan Funds:

Loan funds (net of any closing costs or other disbursements to be paid at the initial funding) will be disbursed at closing into a pledged account - potentially some Loan funds will be disbursed by Lender at closing for approved closing expenses while other funds will be deposited in the pledged account for the Lender-approved construction work. These deposit funds will be disbursed periodically by lender pursuant to a formal loan draw process set forth in the Repair Holdback Agreement. Because the full Loan funds will be disbursed at closing, the entire Loan amount will accrue interest commencing on Day 1.

References in the Repair Holdback and Security Agreement:

Holdback of Loan Funds (aka Non Dutch):

Loan funds for the construction work will be held back by the lender and will not be disbursed at closing (Holdback Amount); however, Loan funds for other purposes (e.g., property acquisition, closing costs, etc.) will be disbursed at closing (Initial Disbursement Amount). These holdback Loan funds will be disbursed periodically by lender pursuant to a formal loan draw process set forth in the Repair Holdback Agreement. Because a portion of the Loan funds will not be disbursed at closing, interest will accrue only on the Loan funds disbursed and outstanding at any given time during the Loan term.

References in the Promissory Note:

![]()

References in the Repair Holdback and Security Agreement:

Holdback of Loan Funds Option 2:

Difference between Holdback of Loan Funds Option and Holdback of Loan Funds

Option 2:

References in the Promissory Note:

References in the Repair Holdback and Security Agreement:

Holdback of Loan Funds (Full Loan Interest Accrued) (aka Dutch):

Loan funds for the construction work will be held back by the lender and will not be disbursed at closing (Holdback Amount); however, Loan funds for other purposes (e.g., property acquisition, closing costs, etc.) will be disbursed at closing (Initial Disbursement Amount). These holdback funds will be disbursed periodically by lender pursuant to a formal loan draw process set forth in the Repair Holdback Agreement. Notwithstanding that a portion of the Loan funds will not be disbursed at closing, interest will accrue on the full Loan amount from Day 1 even though portions of the Loan funds will be disbursed at various times during the Loan term.

References in the Promissory Note:

![]()

References in the Repair Holdback and Security Agreement:

Holdback of Loan Funds (Full Loan Interest Accrued) Option 2:

Difference between Holdback of Loan Funds (Full Loan Interest Accrued) and Holdback of Loan Funds (Full Loan Interest Accrued) Option 2:

References in the Promissory Note:

References in the Repair Holdback and Security Agreement:

Difference between Holdback of Loan Funds (Full Loan Interest Accrued) Option 2 and Holdback of Loan Funds Option 2:

Depending on the Note type, the difference on how the funds are disbursed between Holdback of Loan Funds (Full Loan Interest Accrued) Option 2 and Holdback of Loan Funds Option 2 will be in Section C of the Note only:

Please select the appropriate Completion Date from the three drop down options [Standard (Completion Date), X days after loan funding OR Date(s) identified in schedule(s) below]:

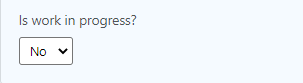

The customer will then need to answer if repairs are already in progress: select "yes" if in progress or if repairs have not been started select "no".

Lender Protections of the Repair Holdback Agreement

Please be advised that our Repair Holdback Agreement provides certain lender protections you should be aware of.

First, the Holdback Amount shall only be disbursed for the payment or reimbursement of the Lender-approved costs for completion of the Repairs (agreed to in the RHA).

Second, at the Lender's option Lender may make disbursement directly to the applicable contractors, laborers, and materialmen.

Third, Prior to disbursement of the Holdback Amount, Borrower needs to deliver to Lender a written request for each release accompanied by evidence satisfactory to Lender that the applicable Repairs have been completed and paid for by Borrower. At Lenders' discretion, Borrower must also pay for and deliver to Lender either a Contractors Certificate, a Borrower's Certificate, Engineer's or Inspector's Certificate, an endorsement to the title policy for the lien of the Mortgage, or other certificates. The borrower's certificate must state, in part, that the Repairs have been fully paid for and no claim or claims exist against Borrower or against the Mortgaged Property or Improvements out of which a lien based on furnishing labor or material exists or might ripen.

Fourth, according to paragraph 1(c) the Borrower can make no departure from or alterations to the Schedule of Required Repairs without the Lender's prior written consent. Lender is permitted to inspect the Repairs and Mortgaged Property. Works must be completed to Lender's approval. Lender has the right, but not obligation, to complete the Repairs.

Lastly, according to section F.1 of the Loan Agreement, any fraud or misrepresentation or material omission by Borrower in connection with any request for Lender's consent to any proposed action, including a request for disbursement of funds under any Collateral Agreement (the RHA) is an Event of Default.

GoDocs Software Output Sample

LoanDocs Sample Deposit of Loan Funds

LoanDocs Sample Holdback of Loan Funds

LoanDocs Sample Holdback of Loan Funds Option 2

LoanDocs Sample Holdback of Loan Funds (Full Loan Interest Accrued)

LoanDocs Sample Holdback of Loan Funds (Full Loan Interest Accrued) Option 2