Texas Deed of Trust

Explanation for the Texas Deed of Trust Questions from the Loan tab:

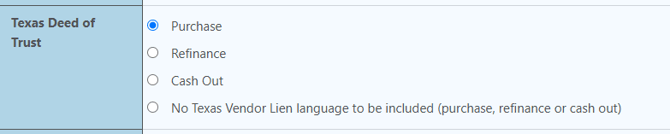

In the GoDocs UI, for Texas Property Loans there are three (or depending on your setting - four) options that provide different language in Section Y of the DOT. Select if this transaction is: (1) a Purchase Money Mortgage and the borrower is not the owner of the property before this loan, and you wish to add GoDocs' standard Texas Vender Lien language, (2) a Refinance/Extension when the borrower owns the property prior to the loan (regardless of lien priority of this loan) and you wish to renew, extend, and/or carry forward an existing Texas Vendor Lien, or (3) when it is not a purchase money loan:

-

-

Following, or at the time of, the customer's loan documentation order submission, the customer may request a LegalNet partner law firm (an "LNP") conduct a review of the loan documentation and otherwise perform services required by the governing law of the loan transaction to ensure the preparation of the loan documentation by GoDocs and/or a non-local attorney do not run afoul of state unauthorized practice of law statutes or other authority(ies).

-

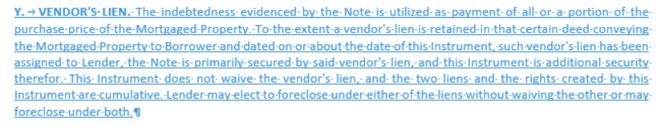

For loans where the governing law of the loan transaction is Texas, the scope of the LNP's Local Counsel Review pays particular attention to the Texas Deed of Trust and how the lender's lien is acquired at the time of the closing of the loan. To that end, when the customer orders a Local Counsel Review for an order, the customer will upload the title commitment for the property which will serve as collateral for the loan. The LNP will review the title commitment insofar as to determine the proper language in Section Y of the Texas Deed of Trust is included to reflect the Deed of Trust is in connection with a purchase, refinance, or cash out (individually and collectively, the "Lien Language"). The LNP will provide also review memorandum for each Local Counsel Review ordered, wherein the LNP will provide the exact Lien Language required to be entered into the loan documents prior to the closing of the loan. For orders using Standard Support, as a courtesy the LNP will typically enter the Lien Language into Section Y of the Texas Deed of Trust.

-

-

Purchase - Usually this is selected when the loan is a Purchase Money Mortgage and the borrower is not the owner of the property before this loan, and you wish to add GoDocs' standard Texas Vender Lien. This selection inserts this language into Section Y of the Texas DOT:

-

Refinance - This selection inserts this language into Section Y of the Texas DOT:In terms of the Renewal and Extension section for a Texas Deed of Trust our DoT contains a provision entitled "Renewal and Extension." In working with our local TX counsel, GoDocs inserts this provision in our DOT whenever a loan is a refinance of existing debt. As it pertains to the section entitled "Renewal and Extension." do note that this is standard language. By paying off these existing debts, you (new lender) are “stepping into the shoes” of the prior lender, also known as equitable subrogation. Under Texas law, paying off the prior debts allows you (new lender) to assume the lien priority that the prior lender had when it made the loans; no intervening liens since the date of each loan can trump your lien priority. If the liens were extinguished at payoff, new lender would not get that benefit; its lien priority would date from today. Instead, you as the new lender are “renewing and extending” (continuing) the liens (and their priority). When using the GoDocs LegalNet provider, the local Texas counsel reviews each deal and will finalize this passage for you.

-

Cash Out - This selection inserts this language into Section Y of the Texas DOT:

-

No Texas Vendor Lien Language - removes Section Y in its entirety.

Also, please note TX counsel will upload their reviewed package on the files page.