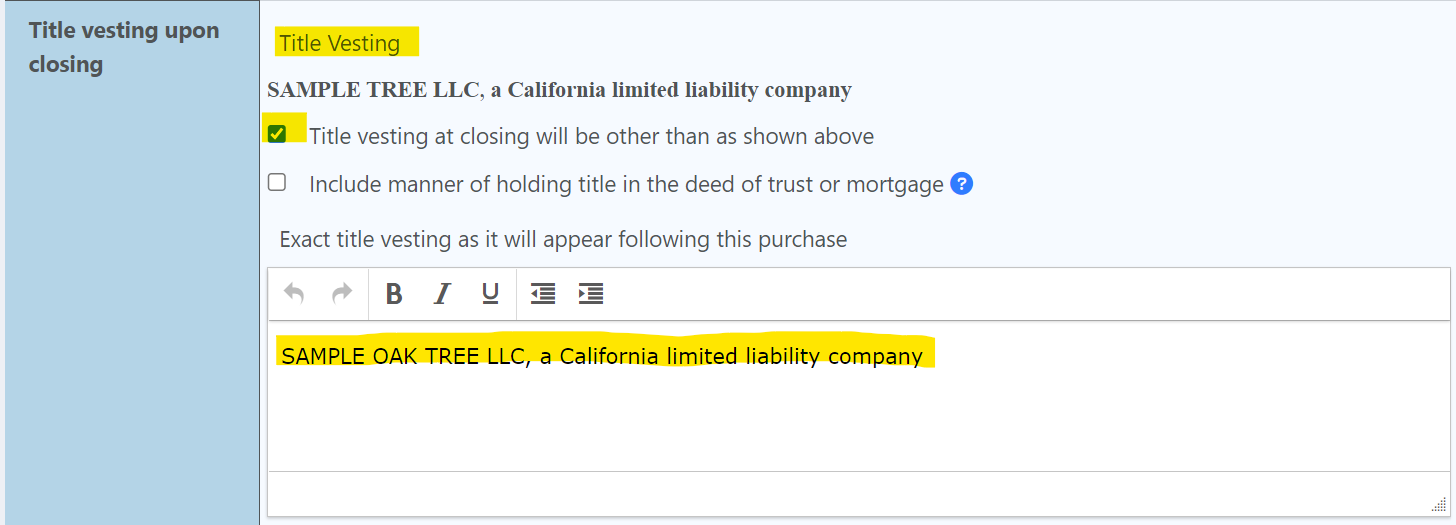

Title Vesting

Title vesting upon closing is different from the GoDocs auto-populated vesting

If title vesting upon closing is different from the GoDocs auto-populated vesting (which is taken from the "Borrower" tab), the customer can check the box in the "Property" tab that reads "Title vesting at closing will be other than as shown above" (Premium support) or "Using customer entered title vesting" (Standard support) and enter the desired vesting.

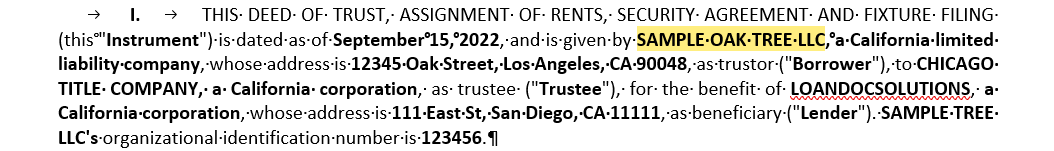

Reference to the title vesting at closing shows up twice in the loan documents: Deed of Trust and Assignment of Rents, Security Agreement and Fixture Filing.

*The box is meant to be checked if the lender, in any particular case, would like for the manner of holding title to be reflected (phrases such as "an unmarried man" or "as tenants in common" or "as joint tenants", etc.). We discourage including the percentage of ownership because it may inadvertently suggest that each borrower's liability under the loan documents is limited to its percentage of ownership of the property (which is not the case) or create any ambiguity or argument in the mortgage or deed of trust in the event that the owners re-allocated ownership percentages among themselves; the ownership percentage is not required to be reflected on security instruments (mortgage, deed of trust,etc.).

Change in Vesting (and Removal of Guarantor):

Both of those options are available under the Assumption Product Type of ModDocs. We can turn that functionality on for you. Please note that we are working on a UI update for the future that will incorporate the assumption (party changes) functionality into our Modification Product Type. Please reach out to Customer Support if you need further help on this feature.

You will be able to see a fee estimate prior to hitting submit order.