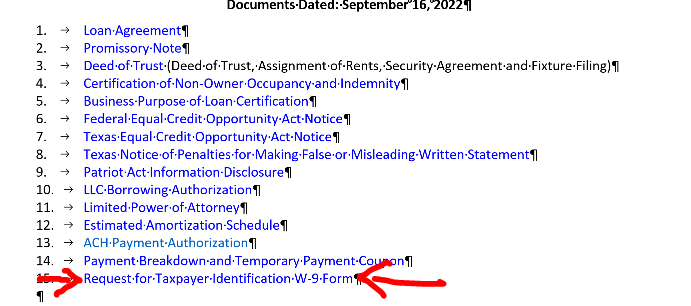

Request for Taxpayer Identification W-9 Form

Form W-9 to provide borrower's correct Taxpayer Identification Number (TIN) to the entity that is required to file an information return with the IRS to report the Mortgage interest you paid.

Lender setting need to be set in order to pull in this IRS form: